Small Business Bank Account: Most Popular Revealed (2025)

21 May 2025As experts in advising SMEs on all their operations, we know the importance of a small business bank account. In our guide to starting a business in 2025, we talk extensively about business bank accounts and how they play THE key role in saving tax when forming a limited company, thanks to their ability to separate your business and personal finances.

So, to go a step further for our clients, and for you, dear reader, we recently surveyed over 300 small businesses to find out which small business bank account is the most popular. You need a business bank account, so why not choose the best?

In our study of over 300 SMEs, we uncovered the top choice for business banking. After analysing 1,067 data points from small businesses, our experts found that (drumroll, please) …

Revolut is the most popular small business bank account; more on why later in this article.

Although Revolut was the most popular account, we found that almost all of our clients had more than one business bank account, each specialising in different things.

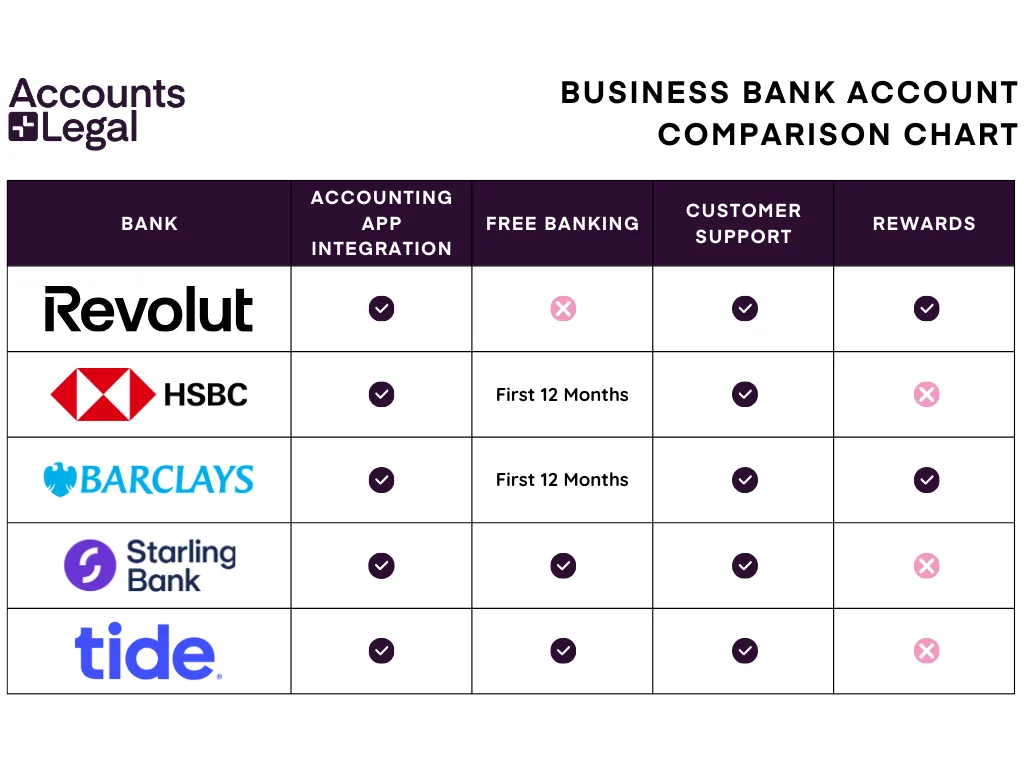

So, in this blog, we’ll rank the most popular accounts from the dataset and highlight the benefits each bank brings to your business to help you make an informed decision when choosing your small business bank account. If you’re looking for the TL;DR version, you can check out our table on the best business bank account below.

An Important Note Before We Get Started

Before we dive deep into the different benefits each bank will provide, we wanted to give you what we personally found was the most important detail first.

Generally, when you come to choose a business bank account, there are two ways you can go: an established ‘brick-and-mortar’ bank or a challenger bank.

As we’ll discuss in this article, each bank will have its specialisms and advantages, but as an overarching theme, your traditional bank usually takes longer to set up, as they’ll want to run more detailed credit checks. However, with challenger banks, the set-up is normally completed the next day meaning you can set up and go.

The reason many choose a traditional bank is due to the ‘feeling’ that your money is safer if you can visit a physical branch. It’s also better for those who prefer face-to-face conversations.

Note: Not all banks listed are part of the financial services compensation scheme (FSCS).

FSCS means everything under £85,000 will be returned to you if your bank goes bust.

Revolut: The Most Popular Small Business Bank Account

Revolut is a relatively new bank, only being set up in 2015, but has quickly risen to popularity with the mission of making foreign currency exchange simple. It takes the top spot as it’s become the go-to for business owners looking for quick setup, low fees, and smooth integration with other accounting apps.

Revolut supports scalability, making it practical for small business owners looking to grow quickly. Small business owners tend to live in a very turbulent world.

To those wishing to do business internationally, Revolut lets customers manage multiple currencies in one place.

Revolut makes managing cash flow easy by making receipts convenient to find.

If businesses have leftover cash, Revolut will give them daily interest on their savings at favourable interest rates.

Check out Revolut for yourself.

HSBC Business Bank Account Ranks 2nd

Second on our list is HSBC. This one isn’t as much of a surprise as it’s known as one of the ‘big four’ bank accounts in the UK. Founded way back in 1865, HSBC was originally set up to support trade between Europe and Asia, with a mission to help businesses.

HSBC has many different bank account choices depending on the structure of the business, with specialised accounts for startups, small business, and larger business bank accounts.

We work with many start-ups as well as long-term stable businesses, and we’ve become accustomed to just how difficult the first year is for small business owners. From our experience, poor cash flow forecasting is a major stumbling block for new business owners, so having an account free for the first year can help in getting settled before yet another expense pops up in the profit and loss account.

Sole traders can gain access to HSBC’s Kinetic Current Account, which is designed to minimise the usual cash flow issues with encountered by new businesses.

The Kinetic current account does this in two ways: first, with cash flow insights directly in the app and second, with easy in-app applications for overdrafts to tide owners over until debtors pay up.

The Kinetic current account currently holds two awards from MoneyNet.

The HSBC account integrates well with Xero and other accounting software, making it a solid choice for businesses looking for a reliable, big-name brand with in-branch support.

So, for those looking to start a new business with support that they can rely on, both in-store and online, HSBC could be a good choice.

Check out HSBC’s business bank accounts.

Barclays Business Bank Account Comes in at 3rd

In 3rd, and the second Big 4 bank on this list, is Barclays. Traceable back to 1690, Barclays is a household name, known by many for sponsoring the UK premiership division since 2001/02. Barclays also installed the first ever cash machine in the UK in 1973.

To support new business owners’ acclimatisation to life with a small business, Barclays offers access to its expert support across a range of industries, which can give a slight leg-up when building business plans.

Barclays also offers 24/7 support, which means business owners can get quicker support when working overseas or late at night.

Like many others on this list, the Barclays business bank account is free for the first year (as long as the user doesn’t have an existing business bank account).

Barclays also provides a free service with accounting software called FreshBooks, worth £260 a year. We don’t use FreshBooks, so we can’t comment from personal experience on how good it is.

But, those interested can read FreshBooks’ reviews to help inform their decision.

Check out Barclays’ business account.

Starling Business Bank Account is 4th

Up 4th is Starling Bank, a challenger bank founded in 2014. Starling is an online-only bank that has gone all in on the mobile user experience front. It seems that their strategy is working so far as a bank that currently ranks 3rd in the UK for overall service quality and 2nd for business service quality. Starling does this by offering 24/7 support from real people online and having a friendly user experience.

Starling also won the Best British banking app 2024.

Businesses can set up a Starling bank account for free, but only with its most basic package for sole traders. However, users can customise their package with add-ons.

Additionally, banking with Starling will give small business owners vital spending analytics so they can manage their money better. Our experts regularly find that many small business owners sign up for pointless subscription-based services and then completely forget about them. Clearing useless spending is the best and easiest way to save cash, and Starling can help with this.

Starling also integrates with other accounting software, so businesses and accountants can get a full understanding of what’s going on with the business’s finances.

Check out the Starling business account.

Tide Business Bank Account is the 5th and final in this list

Coming in at number 5 is Tide, a bank designed specifically for businesses. Set up in 2015, the founders of Tide decided to launch the bank after realising most banks prioritise customer service for their personal bank accounts.

The challenger bank currently are ranked 4th in the UK for best service quality with business bank accounts.

Tide account fee has no standard cost; it’s based on a variable rate depending on what users pay for with an easy online set-up.

Tide also integrates with other accounting software, which can help small business owners keep track of what they’re spending from their Xero account. Integration helps many keep on top of their cash flow, knowing exactly what’s coming in and out of the business.

Businesses can also use Tide’s CreditBuilder, which helps build a stronger credit score for easier access to funding.

Check out Tide’s accounts.

Honorable mentions

While not banks themselves, here are some additional software programs that are very popular with the dataset we analysed.

Wise:

Wise specialises in supporting businesses that operate internationally. With Wise, business owners can provide debit cards to their employees when they travel overseas with zero currency exchange transaction fees.

Like the banks on this list, Wise also works with popular accounting software like Xero.

In terms of fees, Wise has quite a simple standard fee for transfers, depending on what currency needs to be converted and another based on the percentage of the amount being converted.

Check out Wise.

PayPal:

Arguably, the most popular software for processing payments. PayPal gives unique insights into a business; PayPal’s tools are designed to keep customers coming back by supporting businesses build the perfect customer experience.

PayPal also connects seamlessly with e-commerce sites and accounting tools, making it a no-fuss way to pay.

Check out PayPal.

Which Small Business Bank Account Is Right For You?

But which of these business bank accounts is right for your small business?

Well, the truth is, it might be a combination of the banks we’ve mentioned above as each of them offers something unique. In fact, from our data, we found that many of the SMEs we reviewed had more than one of these accounts on this list.

It’s clear that some banks are better than others in different areas, and so choosing a combination of the banks that best suit your needs may be the best option.

Doing business abroad? Sounds like a job for Revolut. Just started and worried about cash flow for your small business? HSBC’s kinetic account could be helpful. Looking for rewards and a big-name bank you can trust? Barclays could be the one for you. Need a great user experience and amazing customer service? How about Starling? Or maybe a bank that has dedicated itself to helping small businesses? Then Tide is the one.

As you can see, different banks specialise in different things, so finding the one which best suits your needs is important. All of these banks will connect to your Xero account, so you won’t have to worry about managing money coming in from loads of different places.

If you’ve decided you just want one account with good customer service, it’s best to review the official government bank survey done by BVA BDRC.

While setting up a bank account is relatively easy, setting up a business isn’t, and it’s why we’re here to help you. Looking to start a business? Or even get your current one on the right track? Then speak to our accountants today. Find out how we could you and your business today.