Private Limited Company Advantages & Disadvantages (Updated 2025)

10 Jan 2025This article is up to date as of February 2025. As CEO of Accounts and Legal, Neil Ormesher brings over 25 years of expertise in tax planning, accounting, and business strategy. A fully qualified accountant, Neil specialises in helping business owners minimise tax liabilities, optimise business structures, and navigate the complexities of tax-efficient business transactions. Here he talks about advantages and disadvantages of becoming a Private Limited Company:

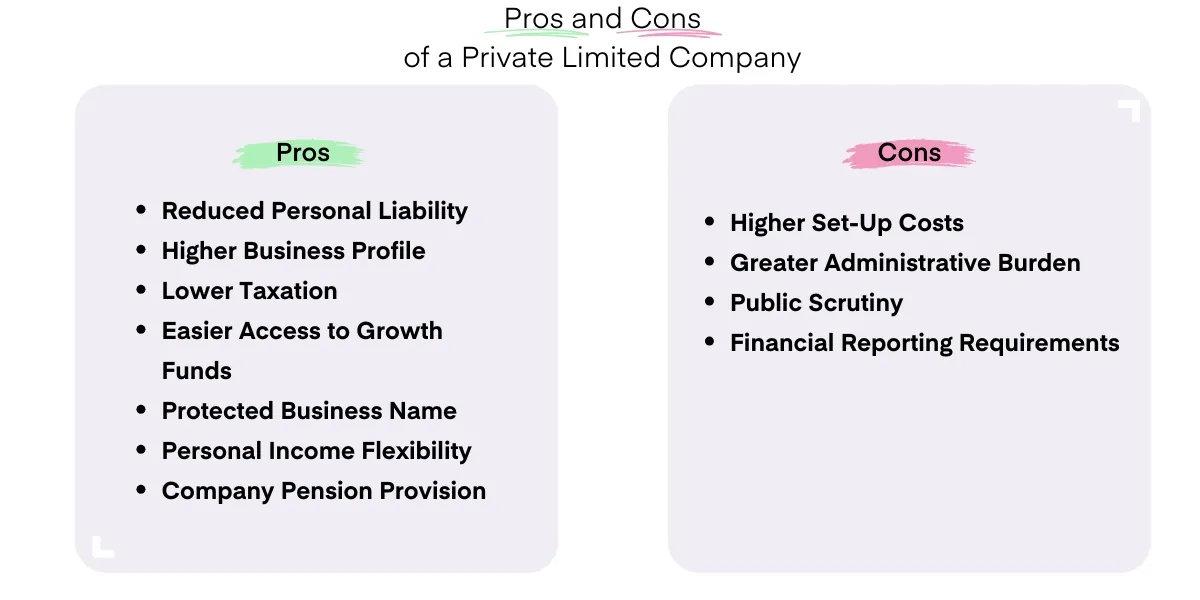

If you’re thinking of starting or expanding a small business, you have a choice of structures – sole trader, public limited company, business partnership, or private limited company. There is no ‘one-fits-all’ solution for a small business owner so it’s important to assess advantages and disadvantages of each before making a decision on your future business structure.

In this article, we look at private limited company advantages and disadvantages to explain what they offer business owners compared to operating as a sole trader. First, it’s essential to answer the question, ‘what is a private limited company?’.

Definition of private limited company

A simple private limited company definition is ‘a company that is a legal entity in its own right, separate from the identity of its owners, and has special status in law’. The assets, liabilities and profits belong to the company, not the owners.

A private limited company is incorporated. It is registered with Companies House and issues shares to its shareholders. It can also be known as ‘a private company limited by shares’.

A private limited company is owned by its shareholders, the people who hold shares in the business. A company can be owned by just one individual who has sole control over all decisions made about the business. Where there are multiple shareholders, each one has voting rights in proportion to the number of shares they hold. If one shareholder has more than 25 percent of the shares, they are treated in company law as ‘persons of significant interest’ because they can influence decisions made about the business.

Advantages of a private limited company

Private limited companies offer a number of important advantages compared to businesses operating as sole traders.

Reduced risk of personal liability

As a sole trader, you are personally liable for all the debts and liabilities of your business. In a private limited company, you and any other shareholders are only liable for debts up to the value of your shares. That reduces the risk of having your personal assets seized to pay for the debts of the business if it fails.

Related: Everything you need to know about Creditors and Debtors

Higher business profile

A private limited company is perceived as more substantial than businesses run by a sole trader. When customers place orders or award contracts, they want to be confident that the supplier has the resources to provide a reliable service. The perception is also shared by investors, so it may be easier to attract funding as a limited company.

Related: What is EIS? - alternative funding options for small businesses

Related: What is SEIS? - Alternative small business funding

Lower taxation

Sole traders pay income tax and National Insurance contributions on the profits of the business through an annual self-assessment tax return. The rate of income tax and National Insurance contributions is equivalent to that of a private individual and includes the same personal allowances.

A limited company pays Corporation Tax, which is based on income minus allowable business expenditure.

However, Corporation Tax rates for smaller businesses are lower than the equivalent income tax rates and companies can claim a wider range of allowable expenditure.

Although you will also pay personal income tax and National Insurance contributions as a director or owner of a limited company, you have greater flexibility in the way you pay yourself, which can lead to savings on your personal tax bill.

Related: How to pay Corporation Tax: A guide to rates & deadlines

Easier access to growth funds

As we mentioned earlier, private limited companies have access to a wider range of funds for growth, including bank loans, venture capital and crowdfunding because investors see limited companies as a lower risk. You can also raise capital by selling shares in your business, although you cannot offer them for public sale.

Related: A guide to crowdfunding and the best crowdfunding sites UK

Protected business name

When you register your business name with Companies House, the name is protected and cannot be used by any other business. Anyone wishing to register a name must check that it is available. If Companies House recognise a matching name or a name that is very similar, they will advise the business and refuse to grant permission. This level of protection makes it difficult for other companies offering copies of your products cannot ‘pass-off’ their products as genuine.

Related: Legal aspects of starting a small business. Don’t make these common mistakes!

Personal income flexibility

If you are an owner or director of a limited private company, you can pay yourself a combination of salary and dividends. As dividends are taxed at a lower rate, this will reduce your tax bill and provide a more tax efficient method of remuneration compared with salary alone.

There are also other ways to take money out of the business as a director, including bonus payments, pension contributions, directors’ loans and private investments. These offer various degrees of tax efficiency.

Sole traders do not have the same flexibility. They take income from the profits of the business and the income is taxed at standard personal income rates.

Related: Calculating tax on dividends: A guide & example

Company pension provision

In a limited company, you may be able to take advantage of a company pension scheme as well as investing funds in a private personal pension scheme. Sole traders have to make their own provision by joining a personal pension scheme and making regular payments.

Disadvantages of a private limited company

While a private limited company offers many important advantages, there are also a number of disadvantages.

Higher set-up costs

When you set up a private limited company, you must follow a number of procedures that can be time-consuming and costly. You must register your business with Companies House, which is not expensive, but only after selecting and registering a business name, appointing directors, nominating shareholders and preparing legally required documents, including Memorandum of Association and Articles of Association.

Sole traders, in contrast, only have to register with HMRC for income tax purposes.

Greater administrative burden

Private limited companies have to maintain three types of legally required records:

-

Records of company activities, such as lists of directors, shareholders and voting decisions.

-

Financial records covering all transactions.

-

Records of persons of significant control.

You also have to comply with any relevant laws, rules or regulations, maintain accurate business records, file accounts and pay Corporation Tax. If the burden is too high, you may have to consider appointing a Company Secretary to handle those tasks, adding to business costs.

Related: The rise of management accounting and its importance to small businesses

Public scrutiny

Your business records held at Companies House are open to inspection by competitors, investors and other third parties. That makes it difficult to maintain confidentiality about turnover, ownership or significant business changes, which can provide useful information for your competitors.

Financial reporting

You must maintain accurate financial records and file them with HMRC and Companies House following the end of the financial year. That means preparing and submitting a full set or an abbreviated set of statutory accounts in accordance with recognised accounting practice.

Sole traders only have to file a Self-Assessment Tax Return, giving a profit figure and a summary of income and expenditure.

Related: Year-end accounts checklist for small businesses

Take professional advice

There are clear potential benefits in setting up a private limited company, but there are also strong disadvantages. Making a decision about the right structure for your business can be complex and must be based on sound business and financial principles.

If you would like advice on the most suitable structure for your business, our team of experienced small business advisers and accountants will be glad to help.

We can provide expert advice and guidance to help you make your decision. If you decide to go ahead and set up a plc, we can help you through the process. To find out more, please contact us at info@accountsandlegal.co.uk. You can also find out about our other tax services get a free accounting quote here.