My restaurant is unprofitable. How do I fix it?

1 Jan 2025It is notoriously hard to make money in the restaurant sector.

The reality is that most restaurants are loss making, and that the market as a whole is barely growing. So why would anyone open a restaurant?

The answer, as every restaurant owner will know, is that running a restaurant is a labour of love that brings joy to the world when done well. So as a restaurant owner, the question is simply – how do you make sure you are one of the 46% of restaurants that are profitable?

Read on to find out!

The Challenges of SME Restaurants

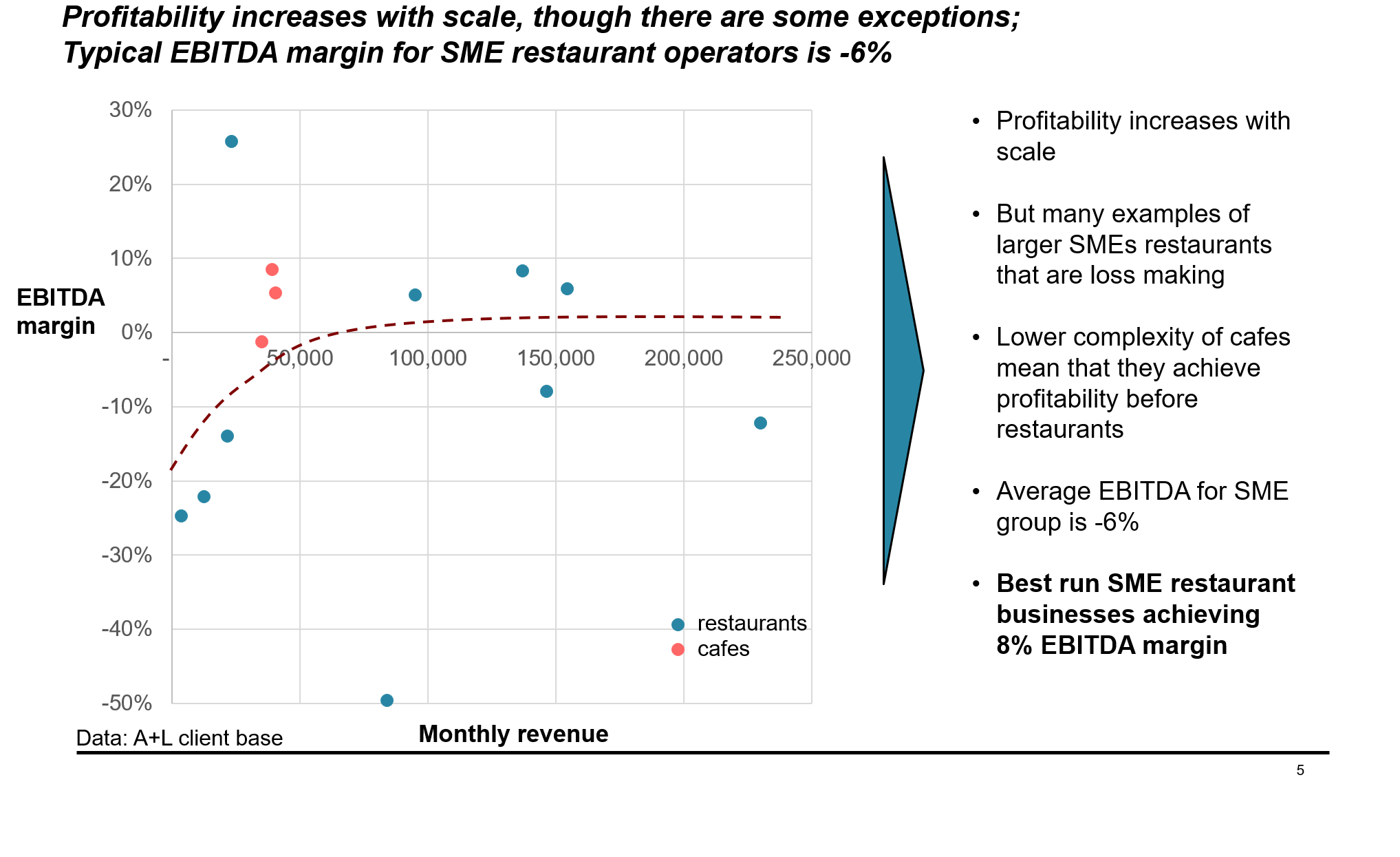

The stark reality is that most SME restaurants are unprofitable, or barely turning a profit. The average EBITDA (earnings before interest, taxes, depreciation, and amortization) for SMEs in this space is negative 6%, while top-performing businesses manage to achieve 6–8%.

To put that into perspective, it’s best to benchmark this against other industries in the UK. For example;

- IT Services and Consulting: These SMEs typically have EBITDA margins of around 13%, reflecting higher profitability, often due to more scalable operations and recurring revenue streams.

- Construction Materials and Manufacturing: These sectors report EBITDA margins between 9% and 14%, driven by strong demand worldwide and beneficial economies of scale.

- Retail and Food Distribution: Food retail and distribution businesses exhibit EBITDA margins near 9–11%, slightly better than restaurants due to lower per-unit margins but high turnover.

The challenge for restaurants, cafes, and bars is clear. Compared to other industries, they run on very fine margins, which leaves them vulnerable to even minor changes to their business. Couple this with a political and economic landscape of uncertainty, and it makes it even more important for businesses to operate efficiently while understanding the financial landscape set out by the UK government. With that in mind, we’ve taken a look at some of the recent government policy changes, which will impact the sector.

Government policy changes have made life harder

Business Rates Relief – Not So “Relieving” Anymore

- The discount on business rates for hospitality businesses has dropped from 75% to 40% starting April 2025, capped at £110,000 per business. For many, this means your rates bill could more than double. For example, restaurants are looking at average increases from £5,051 to £12,122 per year.

- This could make cash flow tighter than ever, especially if you’re operating in a high-rent area such as London or Manchester.

Payroll Costs Going Up

- Employer National Insurance Contributions (NICs) have increase from 13.8% to 15% as of April 2025. Plus, the earnings threshold for paying NICs drops to £5,000, meaning you’ll be forking out more for every employee on payroll.

- On top of this, the National Living Wage is jumping to £12.21 per hour (6.7% increase) for workers 21 and older, with even steeper increases for younger staff and apprentices.

- Bottom line? Expect higher labour costs all around. If margins are already tight, you might need to rethink staffing levels, hours, or even leaning on tech like self-order kiosks to save where possible.

Good News for Beer Lovers (Sort Of)

- Draught beer and cider has had a tax cut (1.7%) as of April 25, which is great if you’re running a pub or bar that leans heavily on these. But duties on spirits, wines, and bottled beers are going up with inflation, so if your bar menu is diverse, it’s a mixed bag.

The effect of these changes will be varied, with many business owners likely exploring cost-cutting measures such as renegotiating leases, reducing staff numbers, automation and self-service.

What It Means for You

- Small Businesses: The rising costs could feel like a chokehold. Small businesses must be extra careful around cash flow and think about creative ways to cut costs, like optimising menus through special offers or leaning on part-time staff. Boosting revenue through an enhanced take away option might also be an option worth exploring.

- Medium-Sized businesses: might have room to adjust prices or delay new openings to absorb the blows, but every penny still counts and medium-sized businesses will still need to be mindful of their operation efficiencies.

- Big Chains: they’ll feel the pinch too, but with more financial wiggle room, they might handle these changes better. Still, scaling back expansions could be on the table

So, with such economic uncertainty as a backdrop, what can restaurants, bars and cafes do to steer their way through effectively? Well, our analysis has shown some important factors to take into consideration.

What drives profitability in the restaurant sector?

At the core of a restaurant’s success are several essential KPIs (key performance indicators) that can often dictate how well, or badly the business performs. To turn things around, these metrics should be a business’s guiding light:

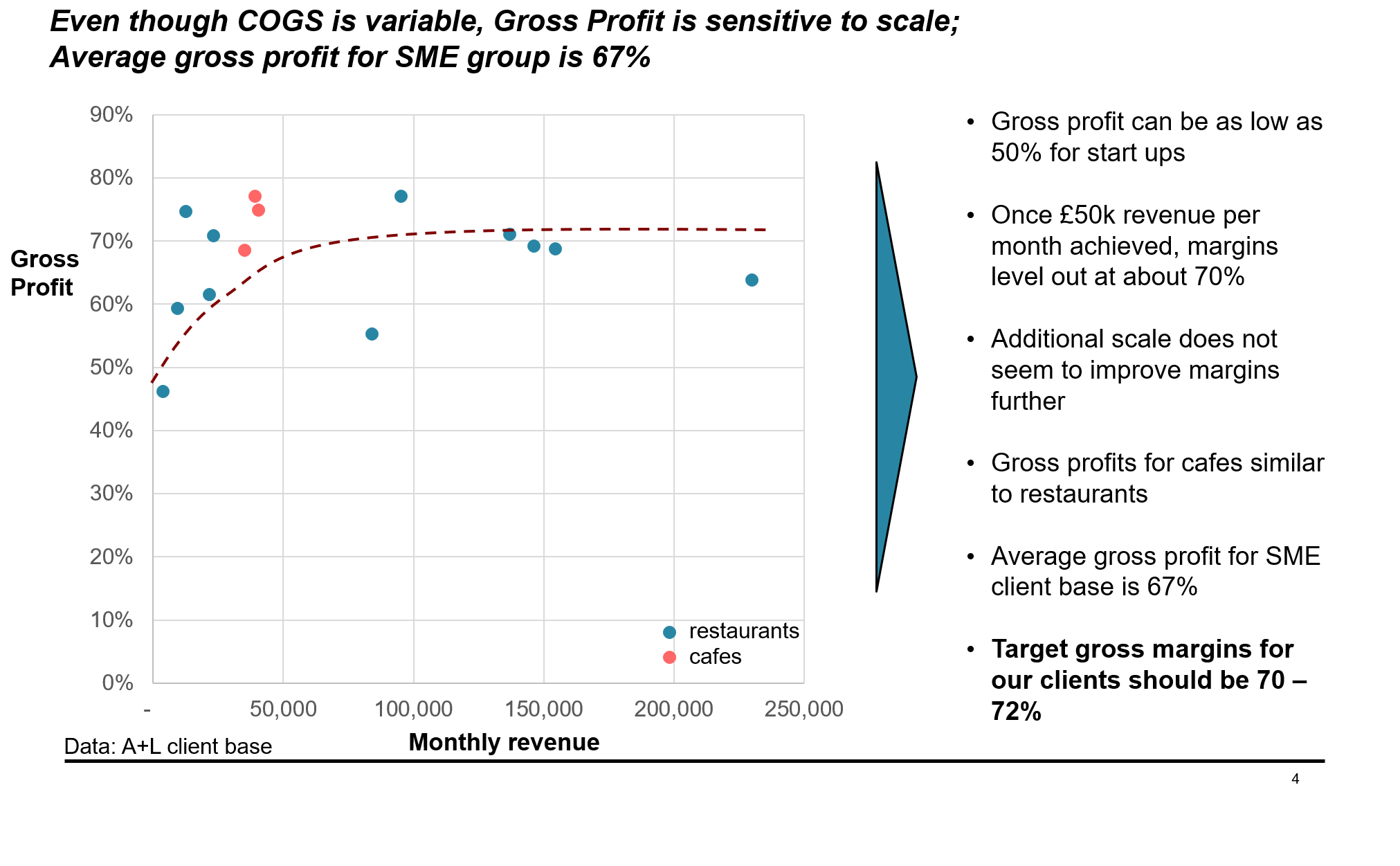

- Gross Profit Margins: the target Gross Profit Margin should be in the region of 70–72% which tends to happen when businesses approach the revenue of £50,000 per month. Once achieved, these margins are manageable—but only with tight control over key costs, like ingredients and labour.

- Revenue Benchmarks: to stay profitable, businesses should strive for £1 million in annual revenue per restaurant, of course, this is easier said than done, but from our research we found this was the critical threshold below which acceptable margins could not be achieved.

- Customer Metrics: boosting average customer spend and fostering loyalty are game-changers. Repeat business is often cheaper to secure than constantly attracting new customers.

- Cost Control: trim wastage, manage staffing wisely, and ensure your back-of-house operations run efficiently. Every saved penny adds to your bottom line.

Is high revenue enough to guarantee profitability?

The figure above demonstrates the relationship between EBITDA margins and monthly revenue for small and medium-sized restaurants and cafes, highlighting profitability trends with scale.

What it shows, is that profitability tends to increase as monthly revenue grows, represented by the upward-sloping dashed curve. Although despite the general trend, there is still a wide array of results, with many larger SMEs still showing negative margins.

The cafes, represented by pink dots, perform better at lower levels compared to restaurants which may be down to their simpler operational models which allow them to achieve profitability earlier, with EBITDA often reaching 5-10% for the best performers.

The restaurants in blue, show much more variability in profitability, with many struggling at lower revenue levels. Larger scale restaurants, or those exceeding the £150,000 monthly revenue mark, approach breakeven or achieve modest profitability, with the best case achieving 8% EBITDA margins.

So the answer is that, if your revenue is over £75k per month, you have a good chance of achieving profitability; below that level, nearly all restaurant businesses are loss making.

Are you paying too much rent?

The revenue-to-rent ratio is an important figure that can shed light on how much bang-for-your-buck you’re getting based on your location.

Rent is often a major cost for businesses, especially for restaurants, cafes and bars. If too much of your revenue goes toward rent, it can leave you with less money for other things like paying employees, buying supplies, or saving for emergencies. What does that mean in real terms? Well, are you spending too much on rent in relation to how much revenue you’re making?

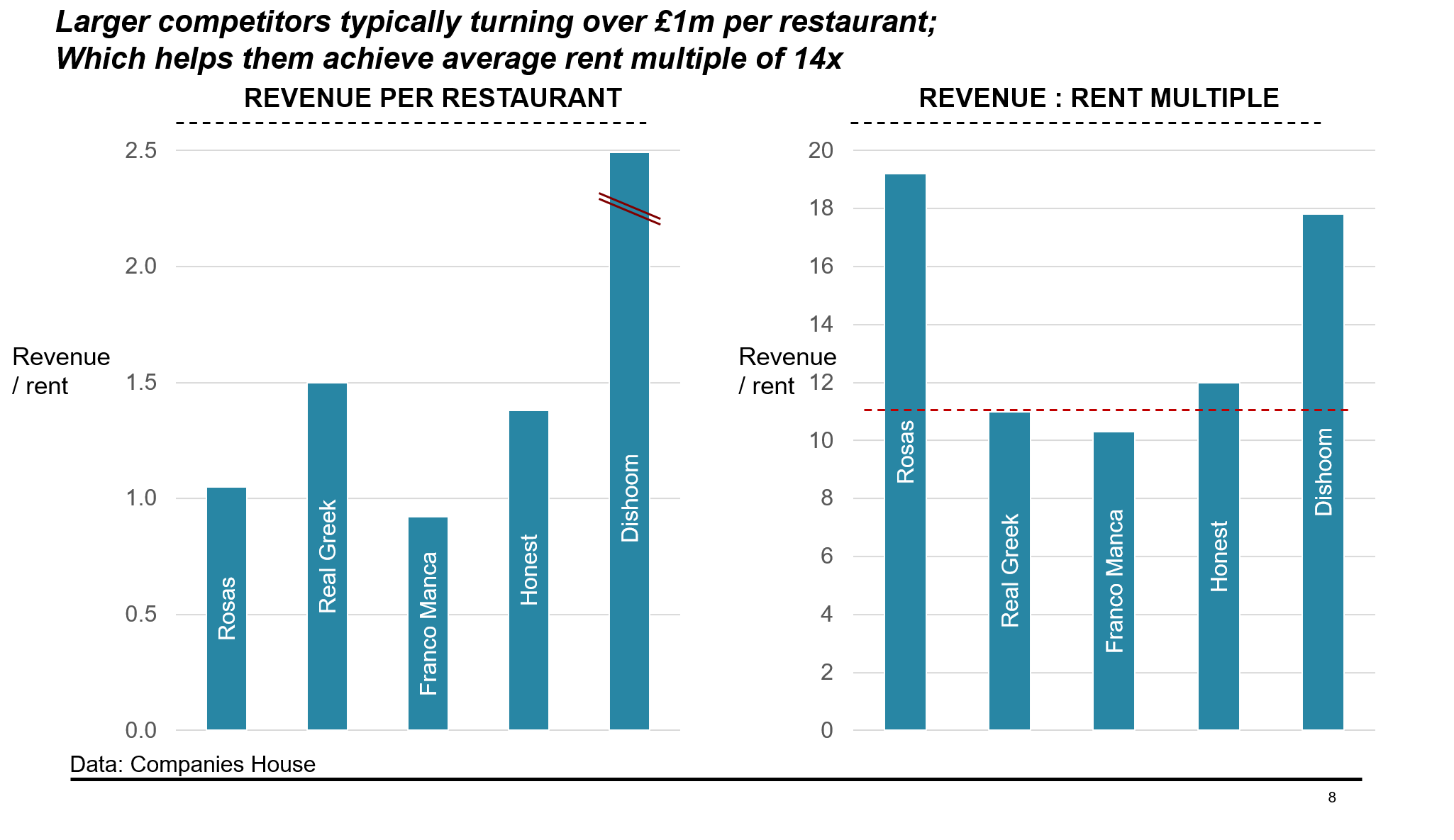

As shown in the graph above, Dishoom has the highest revenue per restaurant, significantly outperforming others by exceeding £2.5 million per site. Real Greek and Honest Burgers show solid performance, with revenue levels slightly above or approaching £1.5 million per site. Franco Manca has the lowest revenue per site among the chains compared, just below £1 million per site.

- Rosa’s Thai and Dishoom have very high rent multiples, exceeding 18x and 16x, respectively, but they do this with much low levels of revenue per site than Dishoom. This suggests these brands are exceptionally efficient at generating revenue relative to their rent expenses and operating with high levels of site productivity.

- Real Greek and Honest Burgers are closer to the average, with multiples around 12x.

- Franco Manca has the lowest rent efficiency, falling below 12x.

From the data, it’s clear that Dishoom stands out due to its high revenue generation per site and strong rent efficiency. The red dotted line represents the average, a rough benchmark of 12x, and brands falling below this are less efficient compared to the industry average.

So, what does it mean? Well, to achieve higher profitability, it is all about the productivity of your site. You don’t necessarily need huge revenues in each location. As long as revenue is more than 10x your rent, you’ve got a good shot at being profitable. Less than this, and it is difficult to break even: our research showed that all restaurants that failed to generate revenue of 7x their rent were unprofitable.

The Scaling Challenge

Scaling isn’t a silver bullet and the stats show that simply opening more sites may not be the most cost-efficient option. Although opening more locations can increase revenue, it also brings complexity and risk. Smaller operations like cafes often hit profitability sooner because they’re simpler to manage. Less costs, less complexity and more potential for a decent margin. For those looking to expand:

- Revenue Goals per Site: Big players average £1 million in annual turnover per site.

- Scaling Strategy: Focus on perfecting your current KPIs before expanding. Expansion without solid fundamentals is risky.

The Main Takeaways (no pun intended)

Gross Profit

The target range for restaurants should be a margin of between 70-72%, which from the data, seems achievable once a business’ revenue exceeds the £50,000. Without a high gross profit to begin with, it may be difficult for businesses to improve profitability, even by scaling their revenue.

Revenue Per Restaurant

Businesses should aim for £1million annual revenue per restaurant, or exceed a 12x revenue-to-rent multiple in order to be competitive and have a solid chance of success. Controlling margins therefore is incredibly important, meaning revenue growth must go hand in hand with tight cost management to push sustainable profit.

Growth

The largest players in the sector achieve 25% annual growth, but this done by expanding to new sites. This is not necessarily the best strategy for smaller players, who stand to gain more by running a single site really well. Opening new locations is often extremely expensive, introduces more complexity and can increase the risk of diminishing returns if each site isn’t managed efficiently. For smaller businesses, increasing average customer spend and encouraging repeat business could be more effective growth levers.

Commercial Optimisation is Key

Although the data may paint a bleak picture, all is not lost. With our clients, those who have achieved margins comparable to the big players have focussed on operational efficiencies and site productivity designed to run a tighter ship and boost margins.

Businesses that prioritise the points below have a chance to run a successful and profitable business:

- Strict cost management and stock checks

- Strategic use of KPIs

- Clever revenue-enhancing tactics

The data displays that profitability isn’t solely tied to revenue size, instead it relates to how effectively revenue is managed. The fine margins within the sector make commercial optimisation an absolute necessity, as even the smallest change could move the needle in the wrong direction if not properly managed. If you’re running a restaurant, café or bar, we’d love to chat, get in touch today.

Sources

Main data source: A+L internal data

https://www.robotmascot.co.uk/blog/ebitda-multiples-by-industry/

https://www.branta.co.uk/q1-2024-review-key-trends-in-sme-business-sales

https://www.merchantsavvy.co.uk/uk-sme-data-stats-charts/

https://firstpagesage.com/business/ebitda-multiples-for-small-business/