Payroll Jargon Glossary by Accounts and Legal

8 Apr 2024If you’ve ever heard of us before, you probably know that we don’t like jargon, especally payroll jargon. It’s complicated, unnecessary, and is only understood by a select few, and after all, who’s got time for that?

Inevitably though, to explain things, you may hear us refer to PAYE or CIS from time to time, and we thought we weren’t doing our jobs if we didn’t try to break it down for you

So, enough waffle, let’s get straight into it.

Absence Management

Absence management looks at reducing the number of employees taking absences and decreasing the number of days taken by sick employees.

Employee absence isn’t entirely avoidable; we humans tend to get sick.

Although sick leave is managed by Payroll, absences can be reduced through a range of policies introduced, mostly by the human resources team, to maintain employee satisfaction and productivity.

Auto-enrolment

Auto-enrolment refers to workplace pensions, a government scheme where all UK employers must enrol their employees onto their pension plan and make contributions.

You only need to auto-enrol employees if all of the following apply to them:

- They’re classed as a ‘worker’

- They’re aged between 22 and the State Pension age

- You’re paying them at least £10,000 per year

- They usually ‘ordinarily’ work in the UK.

Once enrolled as an employer you must contribute 3% of your employee’s salary to their pension while they contribute 5% to make a total 8% monthly pension contribution.

Basic Pay

Basic pay is what is paid to employees monthly without tax reductions and bonuses.

Put simply, if your employee earned £30,000, they would receive a basic pay of £2,500 a month 30,000/12 =2,500.

Bonus

A bonus is an extra lump sum of cash given to your employees on top of their standard pay. Most, if not all of the time, a bonus is given due to high employee performance.

Bonuses are most commonly used to incentivise and reward employees for hard work.

Bankers’ Automated Clearing Services (BACS)

Bankers’ Automated Clearing Services or BACS is a method used by many banks and building societies to quickly transfer cash to each other.

BACS is more commonly used to pay employee salaries.

BACS is relatively inexpensive to run and is a go-to for many large businesses looking to make regular payments.

Childcare Vouchers

A scheme that closed in 2018 but is still available to those who signed up before, the Childcare Vouchers Scheme allows employees to sacrifice part of their pre-tax salary to spend on childcare instead.

We’ll delve into salary sacrifice later down the list.

Commission

Commission is similar to bonuses but more commonly associated with sales teams. In most businesses, the sales team will be given a percentage of the sales they make as an incentive to generate more and larger sales.

The big difference between bonuses and commissions is that bonuses are usually capped, whereas commissions are usually uncapped.

Continuous Employment

Continuous employment simply means working for the same employer without a break in contracts.

Taking a break from work without a break in the contract is noted as an absence and still counts as continuous employment.

An example of a break in continuous employment would be leaving a company to travel for a year and then rejoining when you get back.

Contractual Hours

An employee’s contractual hours will be in their contract, usually as a weekly figure spread over five days.

An annual salary and weekly work hours can be used to calculate employees’ hourly, weekly, monthly, and quarterly pay.

Cost-to-Company

Cost-to-company refers to the total cost of keeping an employee on the payroll.

However, it isn’t just the employee’s salary but also includes the cost of the employee’s benefits package. An example being private medical insurance, as well as the business’s share of the employee’s pension contributions.

Deductions

Deductions refer to what is taken from an employee’s pre-tax salary to give them their post-tax salary.

Common deductions include tax, national insurance, student loan repayments and pension contributions.

Direct Debit

A direct debit is a method of moving money between different bank accounts.

They’re very common not just in payroll but in most day-to-day financial transactions between two entities.

Earnings Before Tax (EBT)

Earnings before tax are similar to basic pay.

Using the same example as we did in the basic pay section, if you earn £30,000, your monthly earnings before tax would be £2,500.

Electronic Payslip

Electronic payslips are a digital method of sending monthly payslips to your employees and are often accessed through payroll portals.

Emergency Tax codes

Emergency Tax codes are temporary tax codes given to employees when HMRC isn’t sure what tax code they’re supposed to be on.

There are 3 Emergency tax codes:

W1 – is assigned to you if you’re paid weekly while HMRC figures out how much you should be earning.

M1 – M1 is assigned to you if you’re paid monthly.

X – This means your tax code is unknown. If you have this tax code, you can imagine HMRC’s head office running around in a blind panic, wondering how much of your income is theirs.

Emergency tax codes are usually replaced with the actual tax code relatively soon.

Employment Allowance

Employment allowance is a specific tax relief employers have access to, to reduce their annual National Insurance liability by up to £5,000.

Here are the boxes you’ll need to tick to be eligible for employment allowance:

You’ll need to be a Business or Charity, (including community amateur sports clubs).

You must be an employer with Class 1 National Insurance liabilities under £100,000 in the previous tax year.

Must be an entity with more than one employer PAYE reference, excluding directors.

End of Year (EOY)

The end of the year, or (EOY), is simply the conclusion of the year, but it can also refer to the end of the financial year, which typically falls on April 5th in the UK.

Equity Compensation

Equity compensation is a non-cash benefit given to employees usually in the form of shares.

The most common equity compensation is a share option scheme.

Expenses

Expenses are costs incurred by employees while doing their jobs, for example, if an employee travels to a client’s office for a meeting.

There is tax relief for those who their own money on things for their work.

You don’t have to pay for employee expenses but for essential work, it is expected.

Final Pay

An employee’s final pay refers to the last paycheck they will receive before they leave their role.

Usually, an employee’s final pay will be more than their standard pay for many reasons.

A common addition to an employee’s final pay will be a payment of any holidays in lieu, which is a payment for holidays that the employee was entitled to take off but has not.

Flexible Benefits

Flexible benefits refer to a company that offers a wide range of benefits that employees can choose from to fit their personal needs.

Employees may also have the option to forgo company benefits in favour of a higher salary.

Full-time equivalent (FTE)

Full-time equivalents refer to employee working hours. To calculate your business’s FTEs, you must first know what your company’s full-time hours are. If, for example, 37.5 hours a week is considered full-time (1 FTE), then 18.75 hours a week is considered 0.5 FTE.

The FTE metric can be useful to business owners who are trying to calculate their profit per employee.

Gender Pay Gap Reporting

Gender Pay Gap Reporting is a legal requirement for organisations with 250 or more employees to publish data showing the difference in average earnings between men and women within their workforce.

The purpose of the report is to highlight any disparities in pay between genders and to promote transparency in pay practices.

The gender pay gap report must be published yearly for eligible businesses with the deadline as follows:

- 30th of March for most public authority employers

- 4th of April for private, voluntary, and all other public authority employers.

Gross Pay

Gross pay refers to the total amount of money earned by an employee before any deductions or taxes are taken out (similar to basic pay).

This includes the full annual salary, as well as any bonuses and commissions earned by an employee.

HMRC (Her Majesty’s Revenue and Customs)

HMRC is in charge of collecting taxes from individuals and businesses.

Income Tax

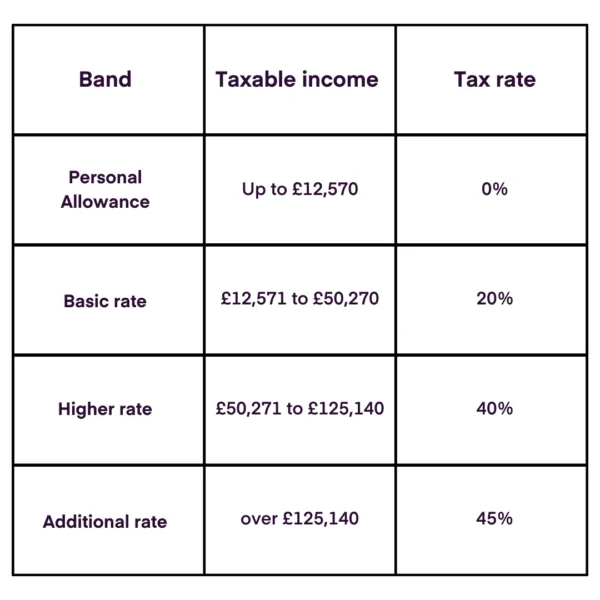

Income tax is what is charged on people’s yearly earnings. There a 4 bands of income tax in the UK that charge 4 different rates:

Here’s an example of the UK tax system that we used in our blog on how much you can earn before tax:

If you’re new to the UK tax bracket system you may fall for the misconception, that moving up a tax bracket means paying the new rate on your entire salary. It’s a common misunderstanding, but it’s not how the system works.

For example, if your salary went from £50,000 to £51,000 a year, your tax rate wouldn’t suddenly jump from 20% to 40% otherwise you’d just refuse the pay rise and stay on £50,000.

Instead, the tax bracket staggers as you go up in salary. So, let’s use that example again, if your salary was £51,000 you won’t pay 40% tax (£20,400).

Instead, the amount of tax you would pay over the year would work out as such:

- You’d take off your tax-free personal allowance (£51,000 – £12,570).

- Then with the remaining £38,430, £37,699 of that would be taxed at 20% (£7,539.80) as it falls in the £12,571 to £50,270 zone.

- Finally, the remaining £729 would be taxed at 40% (£291.60)

- So in total based on the UK tax brackets, with a salary of £51,000 you’d be taxed £7831.40, leaving you with £43,168.60 before other taxes and NI.

Increment

Increments usually refer to how employees receive increases in wages. They are typically granted in set intervals, such as annually or after specific goals have been achieved during the employment period.

Inland Revenue

The Inland Revenue was the former name for the organisation responsible for collecting taxes in the UK, which is now known as HM Revenue and Customs (HMRC).

IR35

IR35 is a method used by HMRC to address tax avoidance by individuals who provide their services to clients through an intermediary, such as a limited company.

For example, if an accountant starts their own business but continues to work exclusively for their former employer as an accountant, they might be considered an employee if not for the intermediary company. IR35 aims to prevent such arrangements from getting past tax and national insurance obligations.

Job Grading

Job grading is used by many companies to simplify how staff are paid in the organisation.

Within each department, each role will have a set salary range with a set list of expected skills and responsibilities required.

This helps with pay transparency across the organisation while giving employees looking to climb the ladder set targets to aim for.

Job Seeker’s Allowance (JSA)

Job seeker’s allowance is a government welfare program that looks to provide a safety net for those out of work while they are looking for employment opportunities.

JSA also supports those who work less than 16 hours per week.

Living Wage

Living wage is what experts believe to be the minimum full-time income required to meet people’s necessary needs.

In the UK there are two types of living wage the first is the national living wage, which is decided by the government and starting from April 1st it will be the minimum wage for over 21s.

The real living wage is an independent body that assesses what the national living wage should be and is usually set a little higher than the national living wage.

Maternity Pay

Maternity pay is support offered to employees before and after pregnancy. Statutory maternity pay is paid up to 39 weeks from when you begin receiving payments. Once you start statutory maternity pay, you receive:

90% of your average weekly earnings (before tax) for the first 6 weeks.

£172.48 or 90% of your average weekly earnings (whichever is lower) for the next 33 weeks.

Some companies can also offer enhanced maternity pay, where they provide additional pay on top of the government’s statutory maternity pay.

National Insurance (NI)

National insurance is an additional tax paid by employers and employees alike to fund specific services. There a 5 different types of national insurance with different rules and rates known as classes.

You pay mandatory National Insurance if you’re 16 or over and meet either of the following criteria:

- You’re an employee earning more than £242 per week from one job.

- You’re self-employed and making a profit of more than £12,570 a year.

National Insurance contributions fund various public services, including:

- Basic State Pension

- Additional State Pension

- New State Pension

- New Style Jobseeker’s Allowance

- Contribution-based Employment and Support Allowance

- Maternity Allowance

- Bereavement Support Payment

Net Pay

Net pay refers to an employee’s salary after all deductions have been made. Deductions include tax, NI, pension contributions, student loans, etc.

Net pay is sometimes referred to as take-home pay because that’s the amount employees receive in their pocket.

Non-Cash Benefits

Non-cash benefits are provided by employers to employees on top of their usual salary.

These non-cash benefits, are also known as ‘benefits in kind’, include items such as company cars or mobile phones.

It’s important to note that many non-cash benefits (benefits in kind) have tax implications.

Overtime

Overtime refers to additional hours employees work that exceed their contracted hours.

Working overtime does not have to be compensated; however, most companies do so in two different ways.

First, many companies will compensate overtime with overtime pay, which is usually paid at a higher rate than the employee’s usual hourly wage.

The second is time off in lieu. This method applies to employees who, instead of taking pay for those extra hours of work, are allowed to take that time off during work hours instead.

P11D

P11Ds are tax forms used by employers to report the value of any taxable benefits (benefits in kind) or expenses provided to employees during the tax year.

Pay As You Earn (PAYE)

PAYE means ‘Pay As You Earn’ and is used by many employers to deduct income tax and national insurance from employees’ wages.

HMRC will use the employee’s tax code to calculate what they can deduct.

PAYE aims to simplify the tax collection process for employees and employers by deducting taxes regularly throughout the year (usually monthly) instead of through a large lump sum at the end of the year.

Through this method of tax collection, PAYE prevents any unpleasant surprises at the end of the tax year in the form of a substantial tax bill.

Payroll Cycle

The payroll cycle refers to the time between paydays.

For example, if a business pays its staff monthly, every month would start a new payroll cycle.

Pensions

Pensions are designed to help people save for retirement by taking monthly contributions and investing them into a diverse range of assets.

In the UK, most employers have mandatory contributions they must make to employee pensions, usually 3% of their employee’s salary.

Employees normally contribute 5% of their salary but can choose to opt out of the scheme if they want. However, employers are not allowed to influence their decision in any way.

There are three different types of pensions:

State pensions – This pension is provided by the government and is based on individual national insurance contributions.

Workplace pensions – Employers contribute a minimum of 3% of an employee’s salary to this type of pension.

Personal pensions – These pensions are chosen by employees independently, but employers can decide to contribute to these too.

Performance Bonus

Performance bonuses are the same as the bonuses we discussed earlier. They can be given to employees for hitting certain targets or contributing a certain amount of effort to the business.

This type of bouns is usually given on top of an employee’s base salary.

Personal Allowance

In the UK your personal allowance is a set amount of earnings you get tax-free. The current personal allowance is £12,571 for most UK workers who will have the tax code 1257L.

Once you begin to earn over this figure, you will enter the UK tax bracket system.

Piece Rate

In some rare situations, employers can choose to pay employees through a ‘piece rate’, where employees are paid for every piece of work they do.

Piece-rate payment was more common during the Industrial Revolution (18th to 19th century) when factory workers would be compensated for each unit they produced.

If you pay a piece rate to your employees they must:

- At least receive the minimum wage for every hour worked

- Paid a fair rate for each piece of work they produce

Redundancy Pay

Redundancy pay is a fixed figure that must be paid to employees you make redundant who have served 2 years or longer.

If your employees are under 22, they will receive half a week’s pay for each year they served.

Employees older than 22 but younger than 41 will receive one week’s pay for each year served.

Employees older than 41 will receive one and a half weeks of pay for each year served.

If you were made redundant on or after 6 April 2023, your weekly pay is capped at £643, and the maximum statutory redundancy pay you can get is £19,290. If you were made redundant before 6 April 2023, these amounts will be lower.

Salary Sacrifice

A salary sacrifice is when an employee agrees to give up part of their salary in return for a non-cash benefit. Examples of salary sacrifices include:

- Larger pension contributions

- Childcare vouchers

- Cycle to work scheme

The reason most employees and employers choose salary sacrifice is to reduce their national insurance bill.

Sick Pay

Sick pay is what companies pay to their staff when they are unable to work. Most of the time, an employee can take sick pay without proof; however, after a certain period (normally 7 days), the employee would need a sick note to continue receiving sick pay.

Statutory Sick Pay (SSP)

Statutory sick pay is the minimum amount that must be paid to an employee on sick leave after the 3rd day of them being away.

For the first 3 days, an employer does not have to pay its employees anything; after that, the employer must pay at least SSP for 4 days.

If the employee can produce a sick note for leave after 7 days, they’re entitled to Statutory Sick Pay (SSP) for up to 28 weeks.

Tax Code

There is a whole list of tax codes in the UK. Tax codes are there to tell HMRC how much they should be taxing your salary.

Tax codes are there in most cases to let HMRC know if you are entitled to your personal allowance.

Time and Attendance

Time and attendance systems track when an employee starts and finishes their workday and the length of the breaks they take throughout the day to ensure employees are paid for the correct hours they have worked.

Tracking time and attendanc is also used as a part of workforce management to ensure employees are working the hours they have contracted to do.

Transfer of Undertakings, Protection of Employment (TUPE)

TUPE, which stands for Transfer of Undertakings (Protection of Employment), is a set of regulations used to protect employees when their organisation undergoes a transfer of ownership.

TUPE regulations aim to safeguard employees’ terms and conditions of employment, which could otherwise be changed by the new owners.

Uniform Tax Allowance

Uniform tax allowance is a tax relief designed to offset the cost of cleaning and maintaining a work uniform.

Employees will need to make a claim by post using a P87 form and submit their receipts with the form.

Variable Pay

Variable pay is pay that is not consistent yearly. Usually tied to performance bonuses, variable pay typically comprises a fixed pay (base salary) and either variable bonus, commission, or other monetary incentives that are paid out based on hitting specific targets.

Voluntary Deductions

Voluntary deductions are deductions from an employee’s pay that are agreed upon voluntarily by the employee.

An employee will usually agree to a voluntary pay reduction if they wish for that money to be used for another benefit, such as a pension contribution.

Wrapping it up

Well, there you have it folks, we hope this blog has helped you understand some of the payroll jargon you hear from time to time.

We know it can be complicated, from SSP to uniform tax allowance, there are many little intricacies to payroll that all come with heavy HMRC penalties if not done properly. We love sharing our wisdom with the world wide web all about the intricacies of accounting, legal, tax, HR and Payroll, but sometimes you just need a dictionary definition.

If you want to learn more about the wonders of payroll, check out our latest blogs and guides on our page.